Saving for retirement is the last thing on everyone’s list of priorities, however with living expenses increasing every year and ongoing market volatility it is important to start thinking 10, 15 and even 20 years ahead.

If you’ve never run the numbers before on packing a lunch versus eating out every day, then you might be surprised how easy it is to save some serious money.

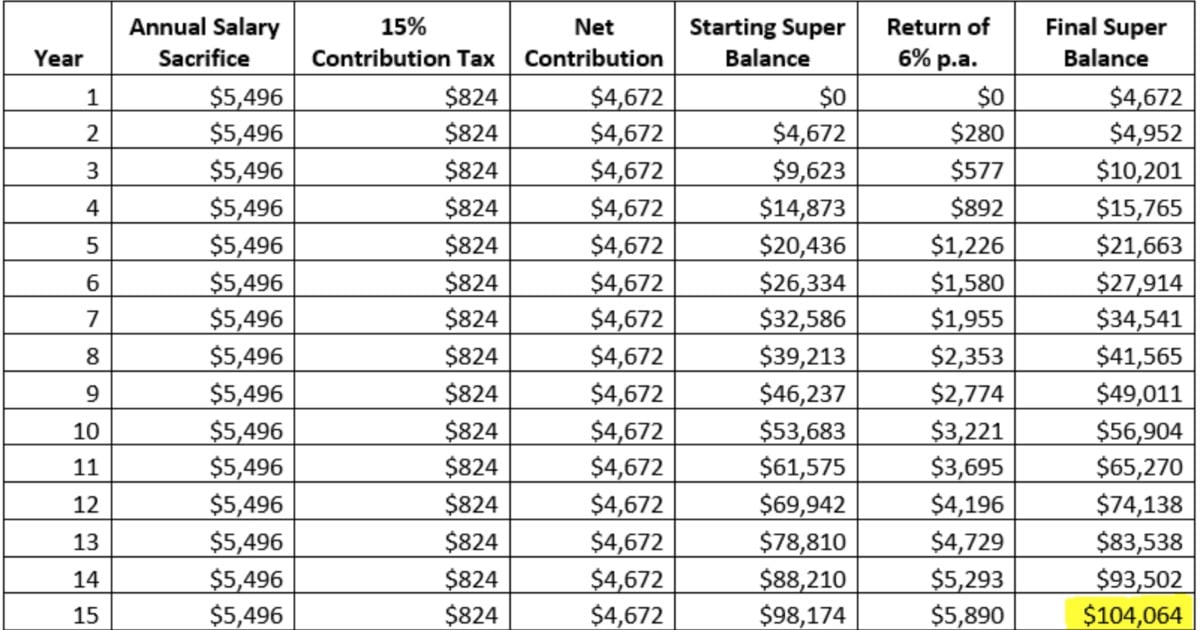

The below table compares spending $20 on lunch and coffee each day versus preparing and supplying this from home at $5 a day and allocating the savings to superannuation via salary sacrifice.

LISTEN: Finance guru Canna Campbell talks about the $1000 Project, and shares her money-saving hacks. Post continues after audio.

A quick summary of the main benefits includes:

- After 15 years there could be an extra $104,000 in your superannuation account (this has assumed a starting balance of zero, so any existing funds have not been included).

- On top of the increasing super balance, there is the added benefit of reducing your personal tax liability each year.

- This is based on tax rates for incomes under $87,000 (if your income is greater than this the savings are even greater!)

- Salary sacrifice is extremely flexible and can be changed or cancelled at any time.

The below table shows the possibility if these funds were salary sacrificed to super each year and how these funds may accumulate over the next 15 years.