Evgenia Bourova, University of Melbourne; Ian Ramsay, University of Melbourne, and Paul Ali, University of Melbourne

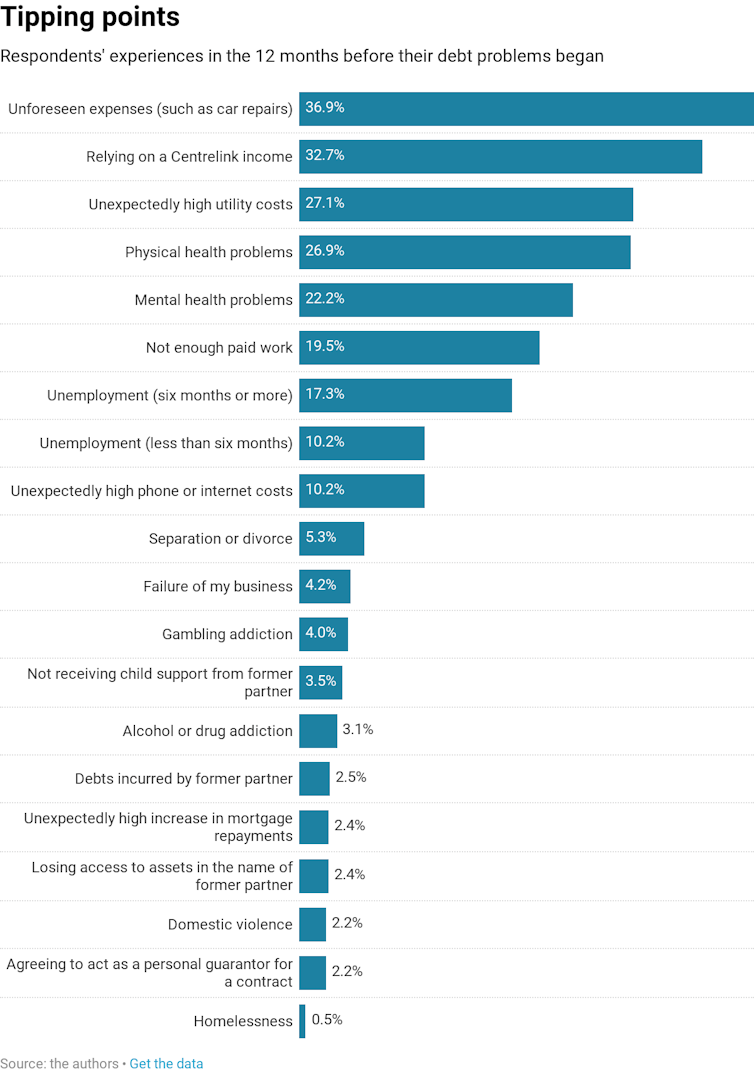

Two thirds of Australian adults feel financially insecure. Almost one in two have less than three months’ income saved, and almost one in three have less than one month’s income. One in seven have negligible or no savings, meaning that financial hardship – being unable to pay debts when they fall due – is just a bill away.

This is something that rightly concerns policy makers. Yet for all the attention given to the problem – for example, in the recently completed Senate inquiry into financial services targeted at Australians at risk of financial hardship – there is little empirical research on the topic in Australia to help inform policy responses.

Team Mamamia confess their debt to the world.

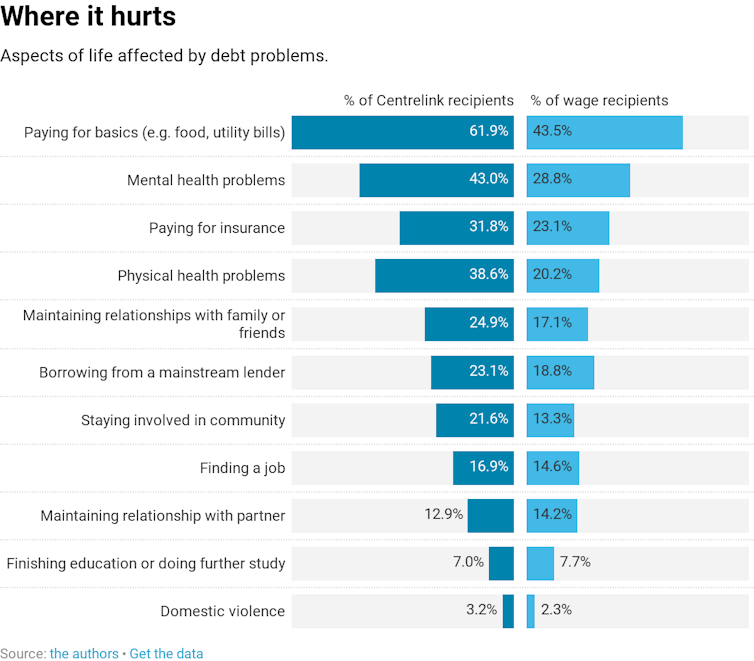

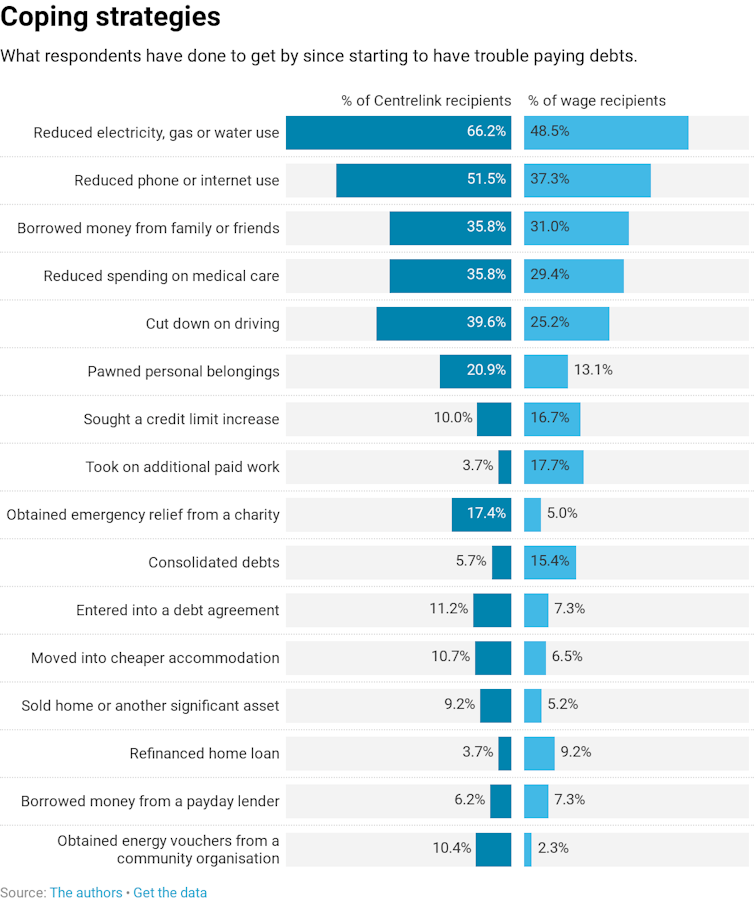

To address this gap, we conducted Australia’s first large-scale study on the experiences of people in financial hardship. We surveyed 1,101 Australian adults who had been unable to pay a debt when it fell due within the previous two years.