"It's just a little treat."

It's something I'm sure we're all guilty of saying at one point while online shopping or at the supermarket, or even after a taxing day at work. Maybe you just feel you deserve to buy yourself something nice after finally ticking that thing off your to-do list you thought would take hours but actually only took five minutes.

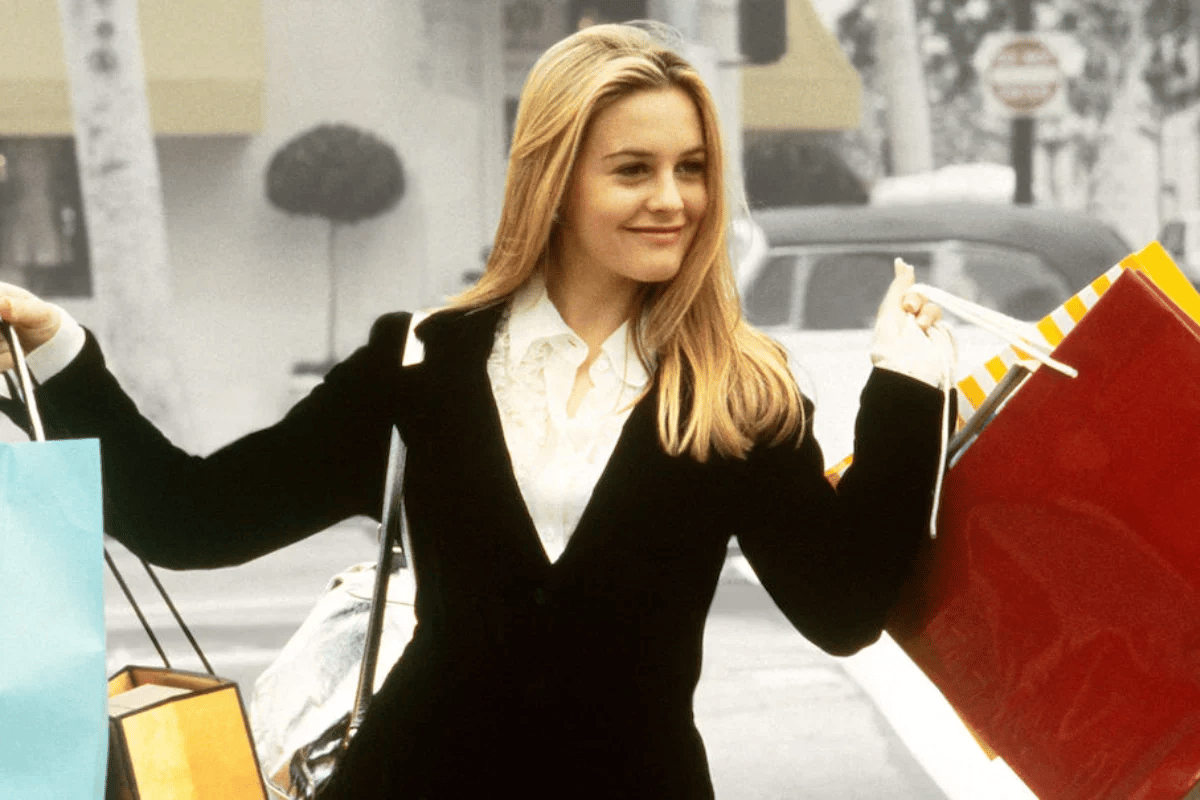

I know I find myself feeling like I should channel my inner Tom and Donna from Parks and Recreation and treat myself to boost my mood a bit too often. Down in the dumps? Treat yourself. Heartbroken? Treat yourself. Proud? Treat yourself.

Let's just say it's definitely not a cheap habit. But why does emotional spending have such a hold on us, and how do you kick it to the kerb?

Watch the five money lessons your parents taught you that you should probably forget. Post continues below.

The "little treat" is about so much more than the item itself, behavioural money coach and former financial adviser Lea Clothier told Mamamia.

"It's about the emotions we're trying to soothe or celebrate. After a tough day, we might feel drained, undervalued, or simply overwhelmed, and buying something small can feel like we are reclaiming a bit of control or joy. It's like telling ourselves, 'Hey, you've been through a lot — you deserve this'," she said.

"But this momentary reward often masks a deeper need, like acknowledgement, connection, or comfort, which a purchase can't truly fulfil. It's a fascinating dynamic because it ties our emotions to our spending habits, often without us even realising it."